When a new government program, policy, or system launches, it’s a safe bet that bad actors will already be at work trying to identify and exploit its vulnerabilities. That’s why responding to fraud can be like aiming at a moving target.

In an ideal situation, there would be ample time and resources to anticipate and reduce fraudulent opportunities by thoroughly vetting policies and rules before a program or policy implementation—but not every system or rollout is perfect. Over the past few years, special pandemic benefits programs have been launched quickly in response to extraordinary circumstances, creating new opportunities for abuse. In what’s being called the biggest fraud in U.S. history, emergency pandemic relief programs were subject to unprecedented levels of fraud up to $80 billion claimed by bad actors in the Paycheck Protection Program (PPP) alone.

According to Bill S., R&D portfolio manager for Peraton’s Global Health & Financial Solutions sector, “Any time you have a new law, or a new program expansion, fraudsters see new opportunities to exploit that program. And their methods are constantly evolving to adapt to security measures and laws. The more complex the system, the more advanced the scheme.”

“We’re the only one-stop-shop in the marketplace today, offering a unique methodology and pricing model that leads to more success and greater customer ROI for our clients,” Bill says. “If you piecemeal it, you will end up spending a lot of money to not find a lot of people.”

What does fraud, waste and abuse look like?

Fraud schemes can be very widespread and organized, perhaps the product of international criminal organizations who set up proxy shops or shell groups. It might be a ring of bad actors domestically, across a group of states, stealing identities. Or it can be on a smaller scale, with collusion between two or more parties, such as a doctor and pharmacy; a doctor and patient; or group of doctors that perform unnecessary procedures or upcode and overcharge.

The real difference between fraud and abuse is intent, but both have the same impact: they deplete valuable taxpayer resources that were allotted to provide care and support to beneficiaries.

“We have to remember that people commit crimes,” notes Bill. “These false claims are the output. It takes dedicated problem solving to identify these individuals and stop the problem at the source.”

Peraton’s enterprise solutions

“Technology is a fantastic asset,” Bill says. “As these fraud schemes become more advanced, and scammer groups become more organized—and reliant on technology—greater technology is required to stop them. However, systems don’t get convictions and an experienced investigator is always required to analyze outputs and make the right decisions.”

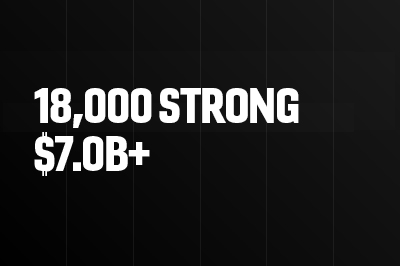

Peraton’s teams are led by experienced professionals with experience in law enforcement, the Department of Justice and the U.S. Marshals Service, whose careers have been focused on fraud investigations. This expertise enables Peraton to develop responsive, end-to-end services that include policy and data analysis, analytics, investigation and review.

SafeGuard Services (SGS), a Peraton subsidiary, has prevented more than $9 billion of inappropriate payments with its SGS Detect product since 1999, consisting of over $5.6 billion in proactively prevented dollars and $3.4 billion in recovered dollars.

Why the government is uniquely at risk

There are challenges faced by the government that don’t exist for a private company, such as a bank or a credit card processor. “The burden of proof is on the government,” Bill explains. “In many states, prompt payment laws create unintended situations where the program must pay first and chase fraud later. This limits the crucial time needed to evaluate what is happening before a payment is made.”

Good anti-fraud solutions will help the government save notably more money than the cost of the fraud prevention tools. It’s a race to identify vulnerabilities and patterns to find out how scammers engage the system and stop them before they’ve succeeded.

Peraton remains committed to providing solutions that integrate seamlessly with already purchased systems and software—and working with the client side-by side, providing training, performing fraud investigation, reviewing claims, and working with the FBI to build cases.

R&D work is currently underway on Peraton’s next generation solutions, which include a new go-to-market fraud offering to be released in 2023.

“To detect fraud, waste and abuse masterfully, you must come at it from many angles. Rethinking, refocusing,” Bill says. “What worked in 2021 may not work in 2022. That’s how you have to approach it. There’s no silver bullet.”

Learn more about how Peraton delivers secure, flexible and agile technology solutions to federal and state customers to ensure American security and prosperity.